Xythum Comparision Report (1)

What is Xythum’s USP ?

-

Darkpools: we will be the first one in the interchain message passing asset sharing space who will be routing their orders through darkpools

- Xythum Darkpool is a private execution layer where user Order details (Sender, receiver, context, Amount etc) are never exposed to any party including until your order is executed.

- In a open markets like blockchain open mempools Darkpools avoids potential Order manipulation, Front running, Sandwich attacks and identity theft.

- use use ZK proofs built using SP1 from succinct labs and FHE to ensure computation and order validation is done on encrypted orders.

-

We are completely decentralized and Trustless

- Xythum will be decentralized to thousands to millions of nodes (achieving the decentralization of Ethereum and Bitcoin and node runners will be incentivized)

- Hence in order to hijack network an attack needs high attack vector of a control over 66% of network which is economically infeasible for anyone by a large extinct on logarithmic scale.

- Hence we completely eliminate trust factor in the system. all components co-ordinator, syncnet, relayers, orderbook, deposit channel will be completely handled by our distributed network making eveything trustless ( NO SINGLE POINT OF FAILURE OR CENTRALIZATION )

- All the witness will be publicly indexed in syncnet for any external user to challenge and verify.

-

We are Robust interchain in messaging space.

- we rely on novel threshold signature scheme goes by the name FROST.

- our bench marks show for a thousand nodes we will able to complete interchain communication under sub second considering network latency 300 ms.

- This is a milestone in todays interoperable space where chains services like layer zero, thorchain, wormhole take more than several minutes to hours to complete bridging (they are only limited to asset sharing)

-

Universal interoperability

- Schnorr signatures based FROST lets us be compatible with wide range of chains not just limiting us to EVM chains

- we onboard Bitcoin, Bitcoin derivates (doge, lite, name, bitcoincash and liquid)

- we onboard variety of L1’s ( Aptos, Sui, Solana, Tron )

- on are compatible with variety of assets, memecoins, ordinals and runes. etc

- Schnorr signatures based FROST lets us be compatible with wide range of chains not just limiting us to EVM chains

-

Xythum VM

- Xythum will be releasing its own distributed VM.

- this lets developers/builders/users to write smart contracts on Xythum (Hooks on Xythum) which are Turing complete and can be triggered based on a cross chain event.

- This allows builders to build interchain apps (chain abstracted apps) which are not single chain dependent yet access liquidity across all chains.

-

Context sharing between chains

- Xythum also lets builders to build apps which can communicate with other chain smart contracts with our entry point contracts

- not just assets we also share context, state between chains

Questions

Is xythum dependent on any exchange ?

- No xythum is an independent entity with its own private execution model. Xythum’s main usp is Context sharing among chains along with assets. we rely on synthetic assets for instant lightning swaps between chains. But one might ask u might have to play a Huge pr Game ?. we say No, its pretty easy to build a single liquidity pool of 130k - 150k on uniswap with a click of a button and that gives xythum to access to entirety tokenized market of chain.

- We have a inhouse product called boundless liquidity with is an aggregator of all potential liquidity markets in the space. and xythum uses its inhouse synthetic and has access to entire market with boundless liquidity

- Once synthetic gets converted often people tend to hodl synthetic and same time provide more liquidity in uniswap liquidity pools

- amount of trades and liquidity pool are co related ( No dependency on any exchange ) just a pool deployment.

- This approach has significant benefits over traditional offchain liquidity pools.

- we also offer parallel markets for p2p instant trades (For highly traded pairs) via adaptor signatures.

Comparision Report: Target - L1x

What does L1x do actually ?

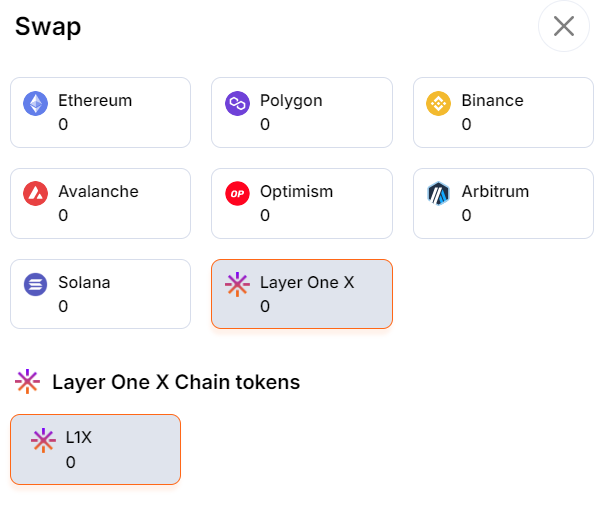

- L1x is layer 1 chain (which they use to post cross chain order data 100k tps and 500ms block creation )

- have onboarded 7 chains

- supports 3 assets

- Total Validator 156

- They aim to do context sharing (future)

Xythum and L1x similarities ?

- Both Xythum and L1x aims to bridge value and asset between chains.

- we both aim to be the fastest in the space.

- we both aim to target universal chains.

- L1x tried to be decentralized did a private node selling to 200 nodes.

- Certain portion of our scalability is same sharding + DAG

How does Xythum play out in head on battle ( Xythum vs L1x ) ?

- L1x is a commercial bridge as of today, with no future roadmap of building darkpools. user bridging through l1x could potentially experience High slippage and order manipulation and loss of value. Where as Xythum with its Key USP being darkpool can onboard high networth individuals and retails users who doest want to fall for high slippages.

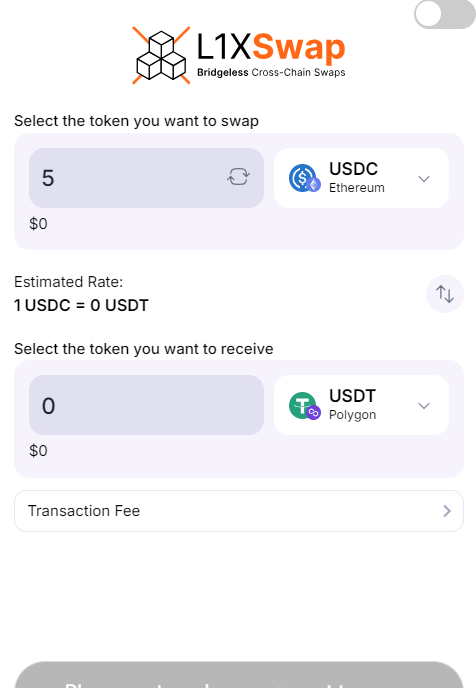

- L1x is not universally interoperable, They lack access to Liquidity of BITCOIN and its derivates (close to 2.5 trillion worth of market) and ignore other major chains tron, cardano, aptos and sui but only focus on 5 EVM and Solana chain.

- Xythum from day one goes mainnet with its Bitcoin and Bitcoin Derivates.

- They dont have their Code not open nor their contract addresses for me to audit. but here are take away from their blogs/whitepaper and articles

- They rely on MULTISIGNATURE contracts which is highly unscalable and pretty centralized approach. It is really costly to manage multisig cluster based architecture on EVM chains or on any chains.

- Bitcoin only support 12 multiSig.

- Their consensus algorithm is over o(N^2). where as xythum is fastest by them by atleast 10 times doing sub second trades

- Xythum relies on threshold signature schemes, which have constant small 64 byte witness whereas L1x has enormous witness data to post onchain bloating chains. and in efficient contract consensus management.

- Sharding in 150 nodes is highly insecure.

- Xythum relies on Frost which is o(N)! and is compatible with Bitcoin and any chain. our signature product is constant across chains rather L1x has to adapt to chains.

- L1x uses Liquidity pool based approach, which is again causes lot of issues for scaling effortlessly, its quite hard to manage in house AMM and liquidity.

Liquidity pools approach makes l1x makes incompatible for bridging (rates are 1 : 0 ) not functional

Questionnaire

-

Addressing technical challenges in proving your solution is scalable and can perform at scale.

-

Regulatory challenges involving Dark Poolings and exchanges,

-

User adoption - How do we build trust on the protocol and build the threshold traction to hit the sweet spot that ensures survival and sustainability for the network. Please work on these issues and also the justification for valuation and funding.

Thank you sir for the review, Here are clarifications on three points

-

we have practical proofs of stress testing frost network with thousands of nodes. and the benchmarking which shows under sub second swaps. FROST was well tested by zcash foundation as well. we have MVP to show Frost based interchain communication. l1x technology is highly incompatible and FROST is shown to have a better performance by atleast large factor

-

we are building darkpools not a mixer like tornado cash or railgun, Our Order execution is private until user orders are executed once order is taken place certain information about order will be public via syncnet. This level of darkpools are legal in regular wall street or Indian markets as well. Hence we are compatible with govt (US, EU, Indian) compliances as well.

-

yes, sir how we build user adoption is a major question! and here is what in our mind.

- Firstly we go by the principle "Dont trust just Verify". we dont have to convince users to trust us. all the witness and trades will be carried out by distributed network. no one has to trust us they can just verify the system.

[ I would like to compare Xythum with highly secured by decentralization projects in space namely bitcoin and Ethereum ], Do we trust these chains ? yes because of their extinct of decentralization! Same goes for Xythum from Day 1 xythum will be decentralized to large extinct such that there will be no one to trust. And it would be economically infeasible for any party to do a sybill attack on the system.

So we dont wanna play the BD game of "trust us", rather we go with the game play verify us, validate us, challenge us. (No trustfactor ever involved).

I would like to tell a story like narration for building user-traction. There is a user goes by the name Alice.

- Alice is a traditional web3 asset holder. but she has her assets fragmented across chains with majority of holdings in bitcoin.

- Alice wanted to use a specific “Lending” application on aptos chain. but her liquidity was stuck on Bitcoin. She thought of using existing bridges but what she noticed was

- Not many Interoperable Solutions options alice has to bridge bitcoin to aptos.

- Interoperable Solutions are too slow (take up to minutes to hours).

- Todays Solutions are pretty centralized hence lack security, often get hacked.

- Bridge operators have alice executive information and exploit it. for their own benifit.

- Bridge based synthetic are not secured, because they go down with the bridge, Alice has to live in fear of holding specific syntheitc

- we have seen this happen in case of BitGo’s wbtc

- we have seen this in case of multiChain.

- Alice sees this as no different from Centralized exchange, she chooses to use centralized exchanges to transfer liquidity.

- But even this approach has flaws being complex and slow process.

- disclosing assets ownership and identity.

- centralized risk

- FTX, MTGOX ….

- CEX sell Alice data to HFT firms and perform arbitrage hiking alice prices.

- Alice would always wants to go full Decentralized user which represents signification portion of current CEX users but secured way to offramp their liquidity to chains and maintain a chain-abstracted portfolio is highly difficult.

[ With all the pain points alice was in search of proper solution, and thats where she landed on Xythum ]

- Xythum offers users universal interrogability,

-

Users wouldn't have to think and research about different bridges to manage their multichain portfolio. They find all chains at one place. and all assets at one place

[ Supporting statement : Xythum is built on FROST - schnorr signature based scheme which is compatible with many chains and easy to implement, which is not the case for existing solutions like L1x , wormhole, layerzero they rely on ECDSA based schemes which are proven to be un-scalable with decentralization ].

This move has high customer retention.

-

Defi Integrations: This is post development BD move, where xythum will be exclusively integrated into existing defi space seemlessly. not a bridging layer anyone rather a batched complex interactions.

- Users will have a simple interface with boundless liquidity, they can be on Bitcoin and still lend on AAVe. they can do native bitcoin swaps on uniswap. and lot more. user can be on Aurora chain and engage in futures contract on Arbitrum via our app.

- Users who would like to use seemless defi applications without worrying about chains and multi chain portfolio, our intent based models will manage their portfolio for them.

[ Supporting statement, we have our own in house product boundless liquidity which shows aggregated asset handling behavior ]

-

speed and cost are two most important things which interchain users complain lot about

-

existing solutions take several minutes to hours and they are costliest for chain and user.

-

Xythum has proven in its benchmarking to complete a swap or value transfer under sub second.

-

unlike existing solutions xythum doesnt bloat chains with enormous witness data to prove its execution. its witness size is constant 64 bytes which is significantly less than existing solutions, L1x has enormous witness data.

-

This less witness size makes xythum faster and cheaper

- Xythum is sharded and follows DAG based syncnet block construction (offers efficiency and speed)

- Xythum supports multiprocessing and async signing, meaning nodes dont have to have context of current order and only be limited to one order execution.

- nodes can handle multiple orders at same instance of time based on their threading capacity.

- Xythum uses chain specific optimisations

- batching.

- RBF and Taproot based assets. etc

[ here we onboard Users/devs to build on us by showcasing the fastest interchain communication ]

-

-

TRUST Factor

- users in todays market are forced to trust centralized bridges and use them, we provide them a truly decentralized trustless communication. which user can freely rely on.

- A user would be willing to hold a synthetic which is backed by thousands of nodes.

- It is economically in-efficient for anyone in the xythum ecosystem to perform a Sybil attack on the platform. Consider reading attacks and defenses section in whitepaper.

- https://xythum.io/media/xythum-whitepaper.16a75cff20e38b83b11f.pdf

- User can freely hold and use the platform without ever being worried about any trust.

-

In current open markets. users face significant information loss.

- Current bridges and solutions are capitalized on this information and exploit user orders to perform, arbitrage, front running, sandwich attacks on user orders.

- This often also leads to identity theft and censorships.

- Xythum implements in house darkpools routing orders through a private execution environments.

- HNI’s and individual retail investors/traders would never have to worry about any order slippage. ever after using xythum

[ this onboards HNIS with ease on to the platform ]

-

- we will be partnering with existing defi solutions to onboard their userbase.

- we are in talks with lead players and apps in the space (Cant disclose the names) to get integrated into the platforms.

- I personally have experience from building earlier startups scaling them to multi million dollar volume.